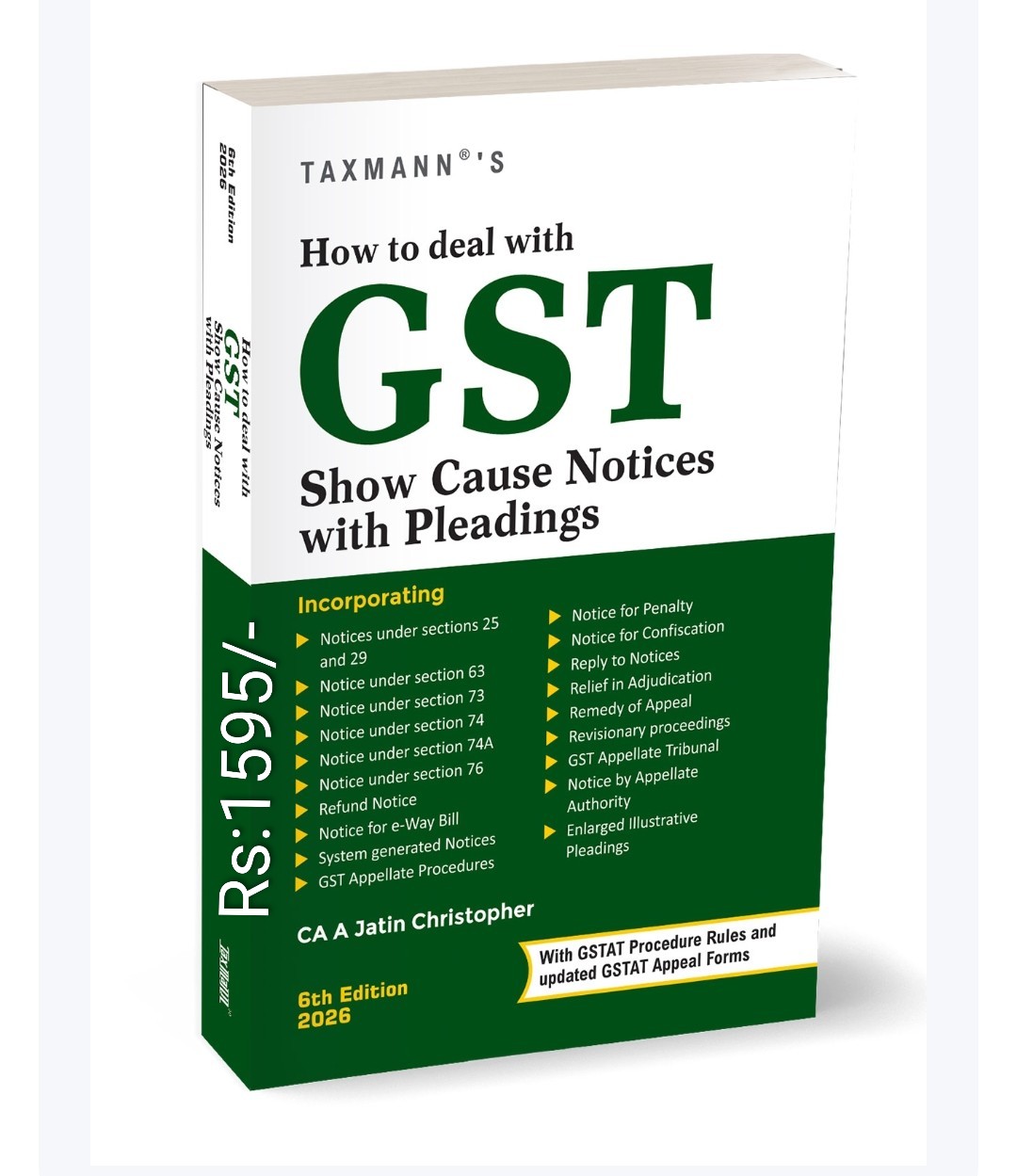

This updated 5th Edition by CA. Jatin Christopher simplifies GST show cause notices (SCNs) at every stage, from receipt to appeals and the GST Appellate Tribunal, incorporating the latest amendments under the Finance Act 2025. It covers key issues like registration cancellations, best judgment assessments, e-Way bill violations, and demands under Sections 73, 74, and new 74A, with clarifications on penalty and interest. Practical guidance, model drafts, and illustrative pleadings help readers draft replies, present arguments, and navigate adjudication, appeals, and revision proceedings. The book explains fundamental concepts like due process, natural justice, and burden of proof, offering strategic insights and case law references. Ideal for tax professionals, corporate teams, GST officers, and students, this user-friendly guide ensures robust legal strategies and procedural clarity for tackling GST litigation.

“INTERPRETATION OF STATUTES- VEPA P SARATHI” has been added to your cart. View cart

How to Deal with GST Show Cause Notices with Pleadings By A Jatin Christopher-6th edition2026

₹1,595.00 Original price was: ₹1,595.00.₹1,115.00Current price is: ₹1,115.00.

0

People watching this product now!

Description

Reviews (0)

Be the first to review “How to Deal with GST Show Cause Notices with Pleadings By A Jatin Christopher-6th edition2026” Cancel reply

Reviews

There are no reviews yet.