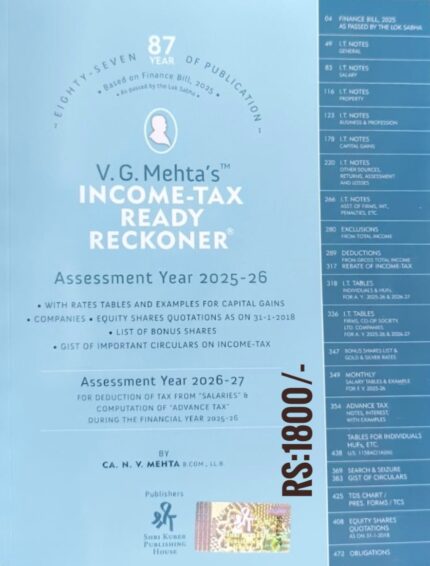

| Chapter | Content | Page |

| PART I | PRELIMINARY | 1.3 |

| PART II | DETERMINATION OF INCOME | 1.3 |

| PART III | ASSESSMENT PROCEDURE | 1.243 |

| PART IIIA | AVOIDANCE OF REPETITIVE APPEALS | 1.265 |

| PART IV | TAX EXEMPTIONS [AND RELIEFS] | 1.267 |

| PART V | REGISTRATION OF FIRMS | 1.320 |

| PART VI | DEDUCTION OF TAX AT SOURCE | 1.322 |

| PART VIA | COLLECTION OF TAX AT SOURCE | 1.368 |

| PART VII | PAYMENT OF ADVANCE TAX | 1.376 |

| PART VIIA | TAX CREDIT | 1.376 |

| PART VIIB | SPECIAL PROVISION FOR PAYMENT OF TAX | 1.377 |

| PART VIIB-A | SPECIAL PROVISIONS RELATING TO TAX ON DISTRIBUTED INCOME OF DOMESTIC COMPANY FOR BUY-BACK OF SHARES | 1.377 |

| PART VIIC | FRINGE BENEFIT TAX | 1.382 |

| PART VIII | REFUNDS | 1.382 |

| PART IX | TAX CLEARANCE CERTIFICATES | 1.382 |

| PART IX-A | SETTLEMENT OF CASES | 1.382 |

| PART IX-AA | DISPUTE RESOLUTION COMMITTEE | 1.386 |

| PART IX-B | ADVANCE RULINGS | 1.388 |

| PART IX-C | MUTUAL AGREEMENT PROCEDURE | 1.393 |

| PART X | APPEALS | 1.396 |

| PART XA | ANNUITY DEPOSITS | 1.400 |

| PART XB | ACQUISITION OF IMMOVABLE PROPERTIES UNDER CHAPTER XX-A | 1.400 |

| PART XC | PURCHASE OF IMMOVABLE PROPERTIES UNDER CHAPTER XX-C | 1.402 |

| PART XI | AUTHORISED REPRESENTATIVES | 1.403 |

| PART XII | RECOGNISED PROVIDENT FUNDS | 1.403 |

| PART XIII | APPROVED SUPERANNUATION FUNDS | 1.431 |

| PART XIV | GRATUITY FUNDS | 1.435 |

| XV | MISCELLANEOUS | 1.438 |

“KARNATAKA SOCIETIES REGISTRATION ACT, 1960 & RULES, 1961 (KARNATAKA ACT NO. 17 OF 1960) WITH Latest Amendments, Notifications and Caselaw” has been added to your cart. View cart

INCOME TAX RULES As amended by Finance Act 2025 by Girish Ahuja & Ravi Gupta

₹2,695.00 Original price was: ₹2,695.00.₹1,750.00Current price is: ₹1,750.00.

0

People watching this product now!

SKU:

IT RULES GIRISH

Categories: Advocates, Charted Accountant, PROFESSIONAL

Tag: CHARTERED ACCOUNTANTS- AUDITORS- TAX CONSULTANTS- FINANCE EXECUTIVES-

Description

Reviews (0)

Be the first to review “INCOME TAX RULES As amended by Finance Act 2025 by Girish Ahuja & Ravi Gupta” Cancel reply

Reviews

There are no reviews yet.